Quicklinks

Menu

March 28, 2023

Developed in partnership with the Australian Government, ygap and Fintech Pacific, the technology puts women-led MSMEs at the forefront of Fiji’s digital transformation

Mastercard and the Department of Foreign Affairs and Trade’s Business Partnerships Platform (BPP), Fintech Pacific and international development organisation, ygap, are working together to develop and deliver an easy to use, accessible payment acceptance platform for women-led small businesses in Fiji.

The partnership will pilot a digital payment acceptance and saving solution for 400 women-led micro and small businesses in Fiji, and conduct the training required to facilitate adoption. The solution is being built from the ground up, tailored to the specific needs of these businesses.

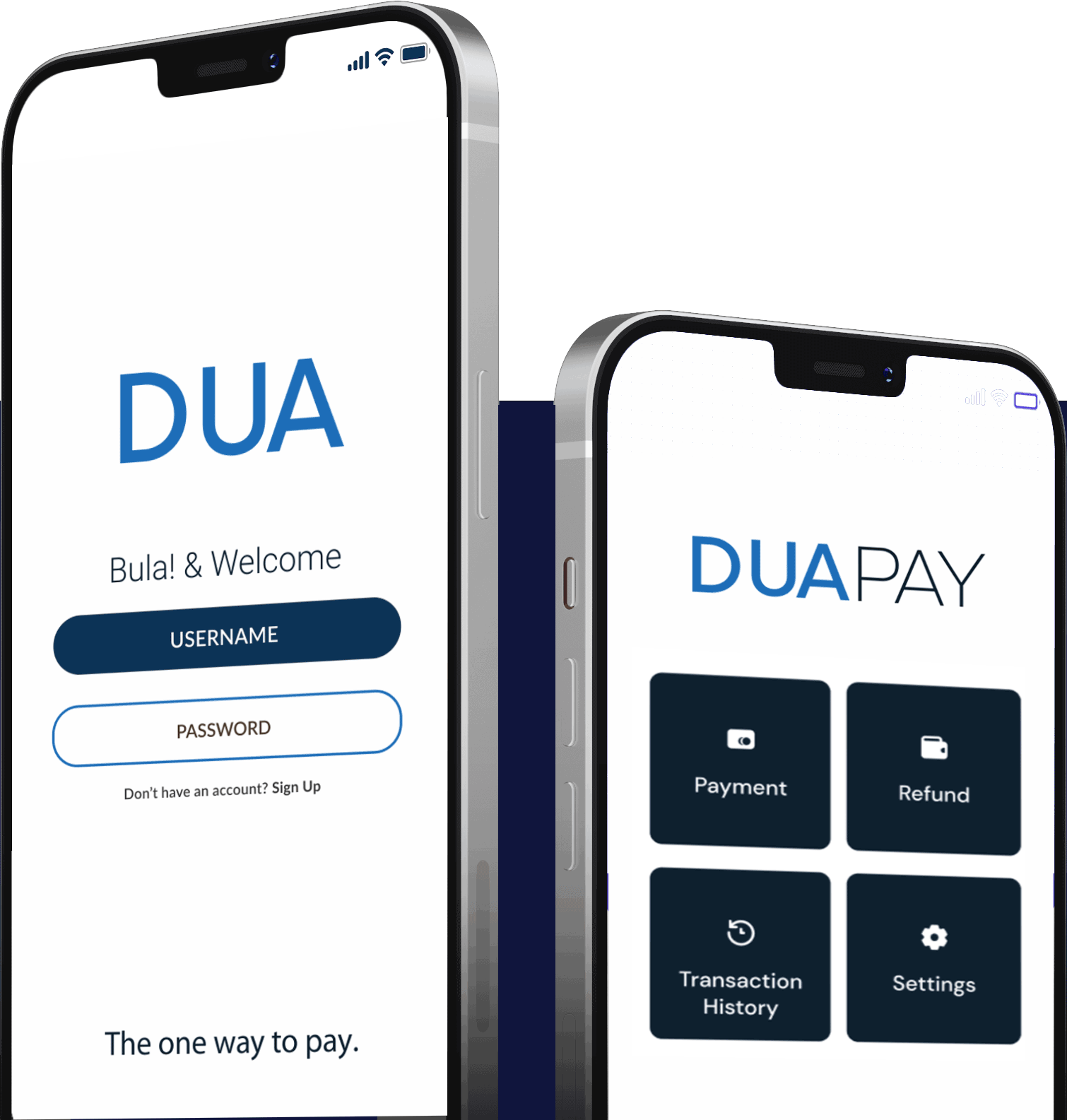

Fiji’s economy has been among the hardest hit globally from the COVID-19 pandemic, with women disproportionately impacted by the economic downturn. Developed by Fintech Pacific, a next generation financial technology provider driving digital transformation to help Fiji, the new app will provide users with an easily accessible digital wallet and a safe and convenient way to accept payments on their mobile device.

Most market stall vendors in Fiji are women, and are typically informal businesses, reliant on daily sales for income, and often only able to accept cash payments. The app will enable MSMEs like these to easily accept card payments from local consumers and international visitors who often prefer to transact using digital payments. This will empower these businesses to increase revenues, strengthen their financial and digital literacy and participate in the global economy.

“Propelled by Fintech Pacific’s locally-led and innovative technology, this unique partnership champions better inclusion for women vendors who traditionally face more barriers in business,”

– Audrey Jean-Baptiste, Director of Strategy and Operations at ygap

“By addressing the issue at both a micro and macro level, from small businesses into the market, women are empowered to grow their income, increase their financial security, support their families and help their communities. Fiji will now be better equipped to recover from COVID-19’s devastating economic impact.”

“Mastercard is committed to financial inclusion and ensuring people around the world have access to financial services, delivering a digital economy that works for all. Collectively, those in the partnership have the tools, technology and capabilities to think big and deliver. Together with Mastercard’s partners at the Australian Government, ygap and Fintech Pacific, the initiative will show how technology can be harnessed to give people more control, better experiences, new opportunities and wider choices,” said Richard Wormald, Division President, Australasia, Mastercard.

The private sector will play an important role in Fiji’s economic recovery from COVID-19 and is a vital source of employment and innovation. Mastercard believes in doing well by doing good and has committed to connecting 1 billion people[1] to the digital economy by 2025. As part of these efforts, this partnership will connect women-led small businesses to products, services, technology and financial support that will help drive forward innovation and fuel inclusive, sustained economic recovery across Fiji.

Mastercard will continue to advance equitable and sustainable economic growth and financial inclusion around the world. It recently pledged $500 million[2] to help close the racial wealth and opportunity gap for Black communities and businesses across America, offering equitable financial tools, investment and partnerships to bring Black women–owned businesses into the digital economy.

Please visit https://www.mastercardcenter.org/ for more information.

Post Tags :

We aim to build open, equal access, payments and financial services infrastructure across the Pacific.

We aim to build open, equal access, payments and financial services infrastructure across the Pacific.